Dimitrios Kambouris/Getty Photos Leisure

Ulta Magnificence’s (NASDAQ:ULTA) Q2 outcomes had been nothing in need of spectacular. On this article, I will be breaking down the wonder retailer’s second-quarter earnings and why I am nonetheless an enormous Ulta bull.

But One other Nice Earnings Report

Shock, shock – one other earnings beat from Ulta Magnificence, and one more reason to personal shares.

Ulta as soon as once more posted record-breaking numbers and elevated its steerage within the quarter.

- Q2 Non-GAAP EPS of $5.69 (vs. $4.52 Y/Y) beats by $0.70.

- Income of $2.3B (+16.8% Y/Y) beats by $100M.

- Comparable Gross sales Elevated 14.4%

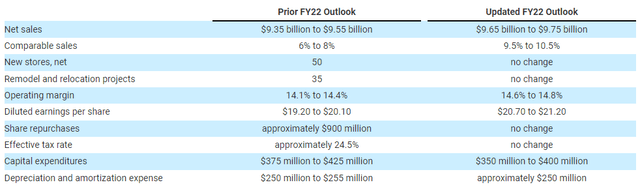

Not solely did Ulta beat expectations, however once more elevated full-year income, EPS, and CAPEX steerage for the latter half of 2022.

Ulta is understood for offering conservative steerage after which rising expectations because it beneficial properties extra readability heading towards the top of the fiscal 12 months. Nevertheless, administration continues to fulfill and exceed expectations, navigating headwinds successfully.

Whereas we proceed to face uncertainties within the present macro surroundings, we’re targeted on delivering nice visitor experiences and driving sustained worthwhile progress. Longer-term, we consider the wonder class will proceed to be resilient, and we’re assured that we’re differentiated and confirmed mannequin and progress technique, mixed with our excellent associates will proceed to place Ulta Magnificence as the popular magnificence vacation spot.

Development on All Fronts

In a time of problem for company America, Ulta continues to indicate progress on all fronts. As soon as once more, comparable gross sales had been up 14.4% this quarter in comparison with the consensus of 10.3%. Whereas Q2’21 noticed comparable gross sales of a whopping 56.3%, the inflated quantity was as a consequence of a brief COVID rebound.

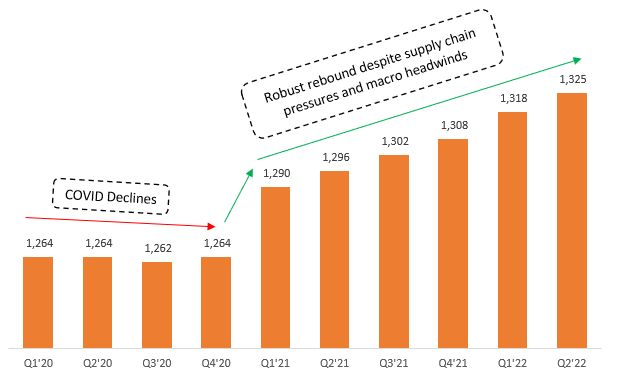

The 14.4% comparable gross sales show Ulta’s robust enterprise mannequin and talent to generate gross sales from its present shops. Additional, Ulta opened 7 web new shops within the second quarter, working its complete rely to 1,325.

Writer Created (Firm Filings)

With macro-headwinds adopted by COVID-19, this can be one of many hardest environments any retailer has needed to face in current reminiscence. Only some days in the past, the market noticed main off-price retailer Nordstrom (JWN) tank after weaker-than-expected earnings and diminished retailer visitors.

Nevertheless, the great thing about Ulta’s progress is that the corporate will not be solely reliant on one section to generate sturdy progress. Ulta generated sturdy progress throughout all of its working segments – Cosmetics, haircare, skincare, and perfume.

Deriving 43% of ULTA’s income, the cosmetics section delivered double-digit comp progress in each mass and status classes. Ulta’s introduction of recent manufacturers and talent to generate gross sales off of present manufacturers proceed to be the spine of Ulta’s gross sales.

CEO Dave Kimbell acknowledged on the Q2 earnings name that:

Friends proceed to have interaction with new manufacturers like Fenty Magnificence, R.E.M. Magnificence and just lately launched about-face by Halsey whereas new merchandise from established manufacturers like Clinique, NYX, e.l.f. and ColourPop additionally contributed to the gross sales progress. As well as, the continued enlargement of MAC and CHANEL Magnificence into extra shops contributed to the robust Status efficiency.

Inside haircare, Ulta’s Attractive Hair Occasion exhibits its dedication to partaking its already loyal buyer base.

our semiannual Attractive Hair Occasion, a strategic occasion designed to accumulate new visitors, improve present member spend and drive salon penetration.

Skincare was Ulta’s strongest income progress section for two major causes.

- New manufacturers

- Academic Content material

newness continued to enchantment to visitors with newer manufacturers comparable to Drunk Elephant, Recent, Supergoop and just lately launched Trip in addition to new merchandise from PEACH & LILY, OSEA and Hero Cosmetics contributing to class progress in the course of the quarter.

Additionally, Ulta doesn’t solely depend on new and present manufacturers to retain clients but in addition focuses on promotional occasions and wonder content material to additional have interaction clients.

Skinfatuation our month-to-month skincare program, which works to demystify skincare with instructional content material and targeted themes delivered good progress for established manufacturers like Tula, Solar Bum, Kola and Good Molecules.

Ulta’s shop-in-shop partnership with Goal (TGT) can be a key lever of progress, with a long-term goal of 800 complete Ulta in Goal places. Within the second quarter, Ulta opened 59 Goal retailers, rising the full to 186 places.

Prospects Will Pay

As inflation continues to hit the economic system with full drive, clients have gotten extra selective as to what they spend cash on. As manufacturers proceed to extend their costs as a consequence of rising enter prices, Ulta should observe swimsuit to keep up its margins.

now we have obtained a massive variety of value will increase from our model companions within the first half of this 12 months. Given ongoing value pressures dealing with our model companions, we anticipate to obtain extra will increase as we transfer all through the remainder of the 12 months.

Nevertheless, Ulta confirmed that their clients are nonetheless keen to buy regardless of the modest value will increase.

When CEO Dave Kimbell was requested about any resistance from clients, his reply targeted on robust progress throughout all classes and revenue ranges.

We’re not experiencing that or seeing that right now, just like what we talked about final quarter. We’re seeing robust progress throughout all elements of our enterprise. As I discussed, each class carried out in double digits, energy throughout channels, shops, e-comm providers. And as we take a look at revenue ranges of our visitors, we’re seeing wholesome progress in any respect revenue ranges. So no actual indicators or indicators of commerce down throughout the market but.

As an organization, Ulta is clearly assured in navigating inflationary headwinds. As talked about in my first Ulta article, the cultivation of a loyal buyer base is a key part of the funding thesis for Ulta. Its best-in-class loyalty program retains clients and will increase their willingness to pay a slight premium.

Ulta’s second quarter proved that the wonder retailer would be capable of navigate macroeconomic headwinds thrown its means.

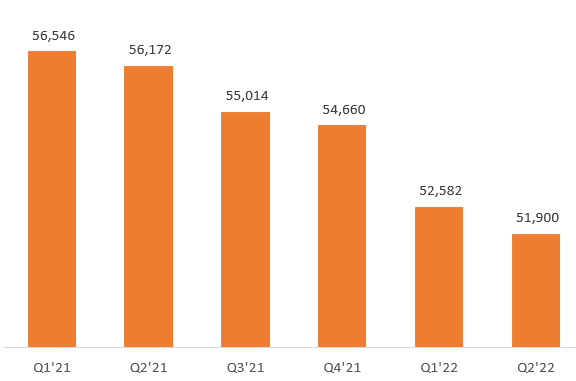

Dedicated to Buybacks

Ulta’s enterprise mannequin is pretty easy with respect to producing money. It allocates a portion for CAPEX, retains a wholesome sum of money to maintain on the steadiness sheet, and repurchases inventory with the remaining. As depicted beneath, Ulta has dedicated to lowering the excellent share rely as a type of capital allocation.

Writer Created (Firm Filings)

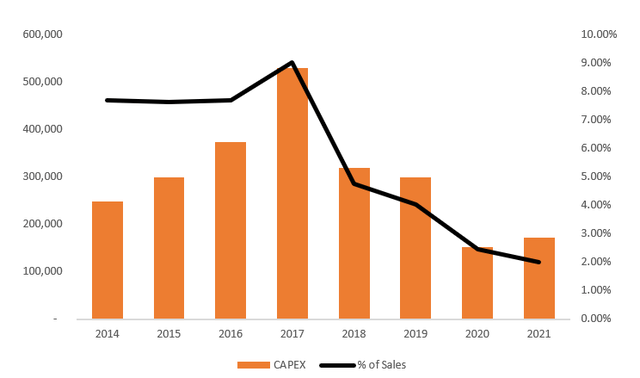

Moreover, Ulta is prudent with CAPEX as a % of income, down from 8% in 2014 to a mere 2% in 2022.

In F’21, Ulta had a money steadiness of barely over $430 million on its steadiness sheet with zero long-term debt.

Pretty Valued

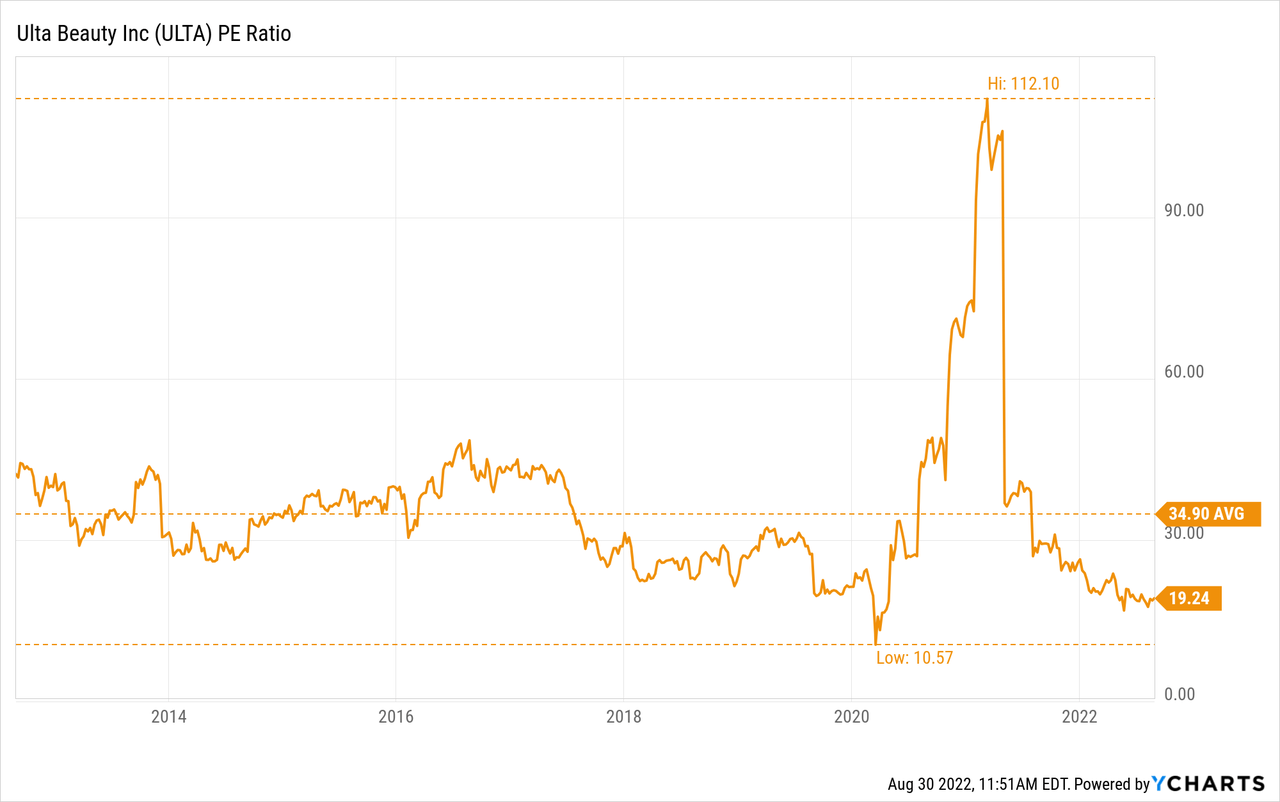

Buying and selling at 20x earnings, Ulta will not be an overpriced inventory. Whereas its peer’s commerce for decrease multiples, Ulta’s business management and progress charges justify the premium valuation. Analyzing specialty retail leaders comparable to Lululemon (LULU) which commerce at ~40x earnings, Ulta is kind of low-cost on a relative foundation.

Buying and selling beneath its pre-COVID common PE ratio, Ulta’s valuation will not be a trigger for concern. Quite the opposite, buyers could even see the present a number of develop sooner or later if Ulta continues to tug the appropriate progress levers.

Future Appears to be like Shiny

All in all, Ulta completed the quarter with one other stellar earnings report. Beating expectations, elevating steerage, rising in all classes, and shopping for again shares are all distinctive sigs for shareholders indicative of a shiny future.

Additional, Ulta has not even begun to faucet into worldwide markets but, focusing utterly on dominating the US market by way of retailer progress, model depth, and buyer loyalty – all of which is able to supercharge Ulta’s future progress.

So long as it continues to deal with its enlargement plans and exceed expectations, the long run will probably be shiny for the retailer. Therefore, I reiterated my “Purchase” suggestion for Ulta.

![Is Ulta open Labor Day? [Updated September 2022] Is Ulta open Labor Day? [Updated September 2022]](https://images2.minutemediacdn.com/image/fetch/w_2000,h_2000,c_fit/https://fansided.com/wp-content/uploads/getty-images/2018/08/1393173784.jpeg)